Traffic Tickets Online: What Every Driver Should Know

How to Manage Traffic Tickets Online Traffic tickets online are now easier to manage than ever, whether you want to pay a fine, check your ticket status, or fight a

Complete the form to schedule a free consultation with a traffic lawyer

How to Manage Traffic Tickets Online Traffic tickets online are now easier to manage than ever, whether you want to pay a fine, check your ticket status, or fight a

Traffic Ticket Lawyer $50 Services Explained Hiring a traffic ticket lawyer $50 may sound too good to be true, but it’s a popular choice for drivers who want help without

DC Speeding Tickets and What to Expect DC speeding tickets are one of the most common violations issued to drivers in the District of Columbia. Whether you’re pulled over by

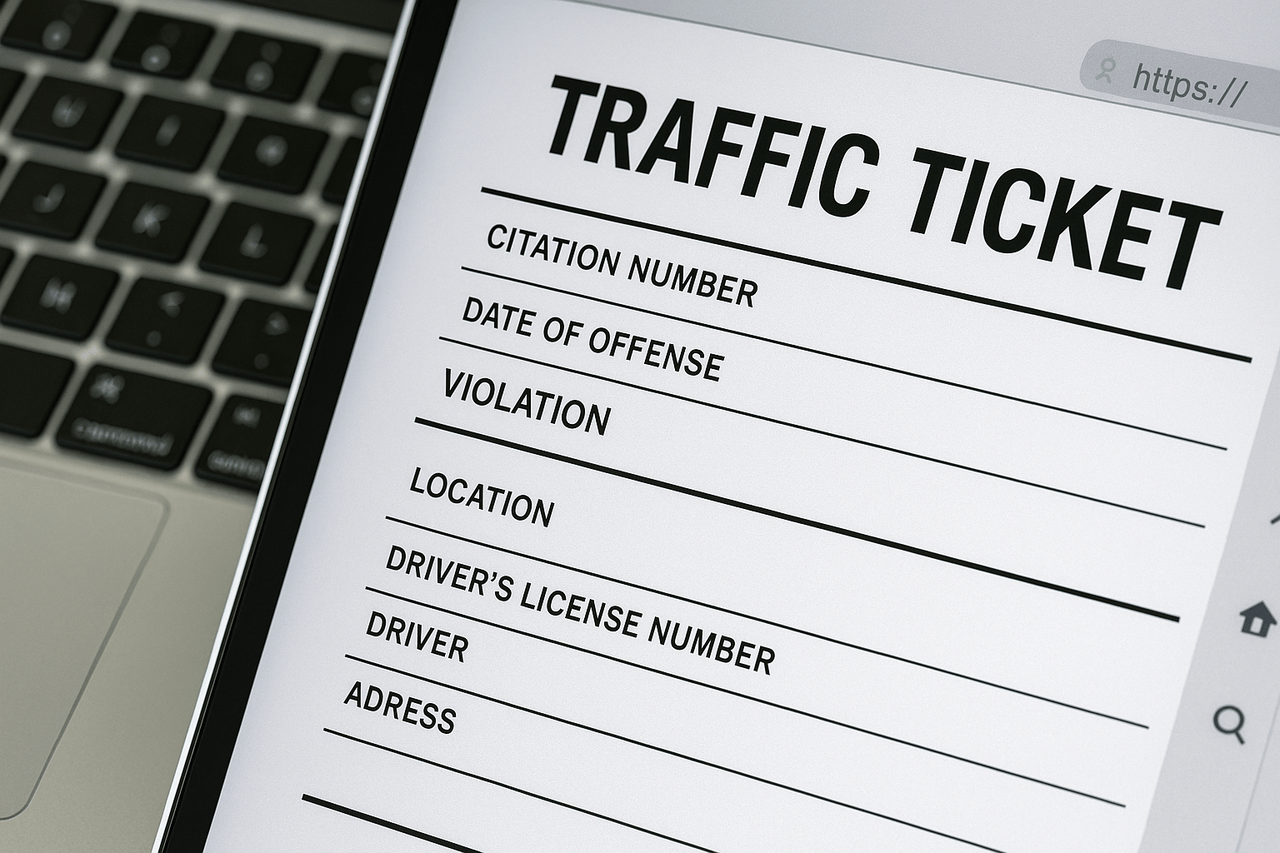

Chicago Speeding Tickets and How They Work Chicago speeding tickets are one of the most common traffic violations in the city. Whether caught by a police officer or an automated

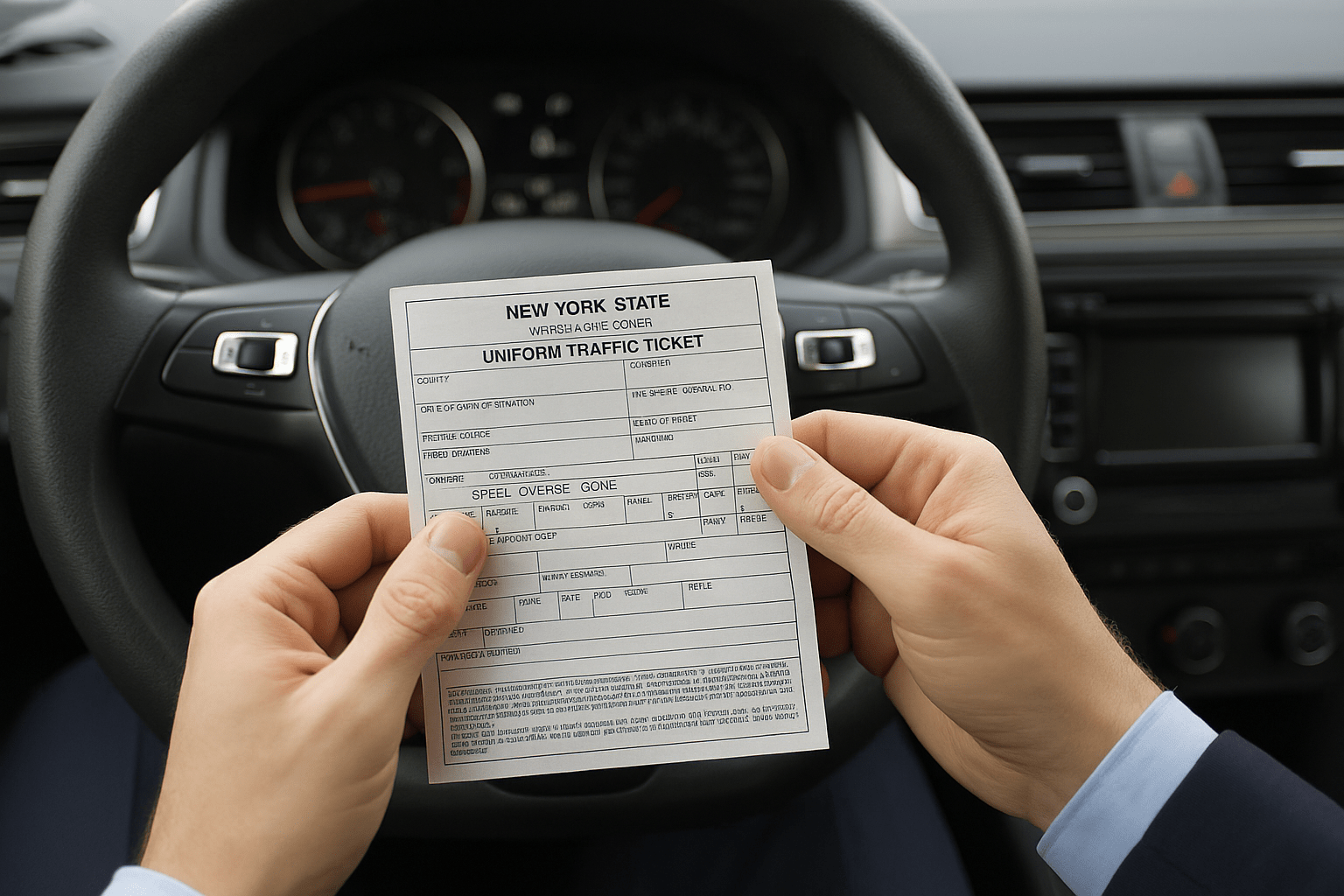

Understanding E-Tickets and How They’re Issued E-tickets are digital versions of traffic citations, and they’ve become the standard for many law enforcement agencies, including those across New York City. Whether

A New Law Inspired by Tragedy On July 1, 2025, Virginia will officially enforce a new Backseat Seat Belt Law requiring all adult passengers to wear seat belts, regardless of

How Traffic School for Tickets Works If you’ve received a citation, traffic school for tickets might be your best way to minimize the damage. From reducing points to avoiding insurance

Understanding Chicago Traffic Tickets and How They Work Chicago traffic tickets are issued for a wide range of moving and non-moving violations. Whether it’s a speeding ticket, red light camera

Understanding NJ Traffic Tickets and How They Work NJ traffic tickets are more than just minor inconveniences—they can lead to hefty fines, license points, insurance increases, and even court appearances.

Understanding Traffic Tickets NYC Drivers Commonly Get If you’ve received one of the many traffic tickets NYC drivers face each day, it’s essential to understand your rights, responsibilities, and options.

Ticket Void is a web service that can help you find an experienced lawyer for Driving Under the Influence (DUI), Driving While Intoxicated (DWI), speeding tickets, careless driving, license plate violations, and other serious traffic violations. Ticket Void expedites your legal search for experienced and reliable DUI and traffic ticket lawyers.

All Right Reserved to Copyright © 2010 – 2025

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |